Liquidity

Liquidity on KoinDX

Welcome to the KoinDX Liquidity guide. This document is designed to provide a straightforward and easy to understand explanation of how liquidity works on KoinDX. Whether you're a beginner or an experienced trader, this guide will help you navigate the process of providing and managing liquidity.

Understanding Liquidity

What is Liquidity

In a decentralized exchange like KoinDX, liquidity refers to the availability of assets in a liquidity pool, facilitating trading between buyers and sellers. These pools are essential for token pairs trading, such as KOIN and VHP. A liquidity pool will only have liquidity if someone provides this liquidity.

How to provide Liquidity

Providing liquidity means depositing assets of a token pair in a 50/50 ratio into a liquidity pool. The Liquidity Provider (LP) receives LP's tokens which representthe share of the liquidity pool that belongs to him.

A reason why users decide to provide liquidity is the fact that 68% of the charged trading fee will be added to the other token of the pool. That means this amount of tokens will also add up to the share the LP owns of the pool.

Providing liquidity at KoinDX is very simple. Take a look at the guide below to learn how to provide liquidity to the KoinDX protocol.

Earning from Liquidity pools

Providing liquidity comes with a really nice incentive. Your LP tokens earn trading fees from the pool's activity. For instance, if you have a 50% share in the KOIN/VHP pool, you'll earn 50% of the fees generated from trades in that pool.

How can I collect the fees

The fees generated by each trade are added to the total liquidity of the pool. The LP tokens that you own represent your share of the pool's liquity. As the total liquidity of the pool increases, your share will also increase. The fees will not be collected individually. The moment you withdraw your liquidity from the pool, your share of the fees will be included.

There is no separate collect-fee function.

What are the fees on KoinDx?

Our fee model is very low priced and simple. Our trading protocol which is used in our Swap (AMM) takes a fee of 0.25%. Part of the fee, 0.17% goes directly to the liquidity providers (LPs). The other 0.08% goes to KoinDX DAO treasury.

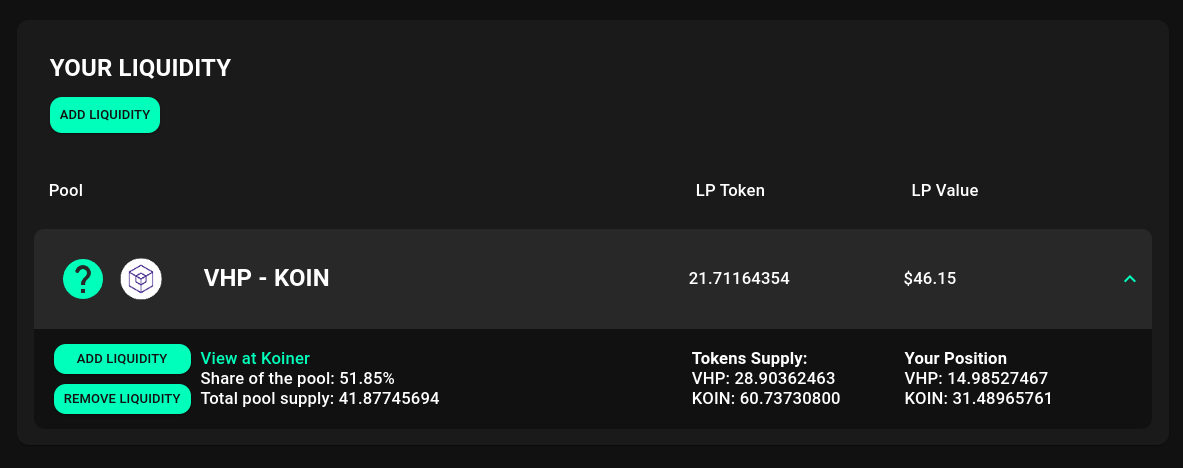

Managing Liquidity on KoinDX

Navigation

Check out the liquidity page of KoinDX.

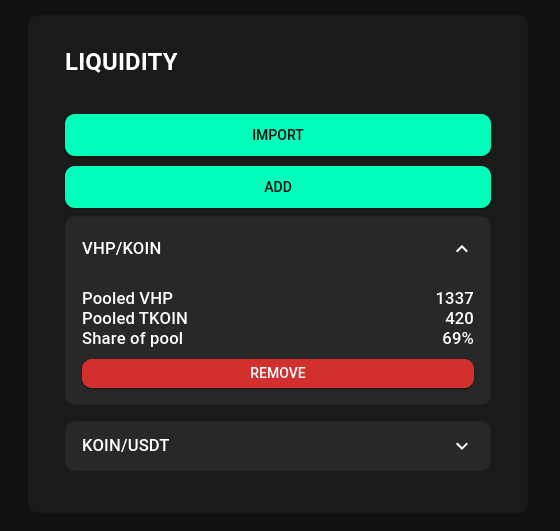

If you have deactivated the KoinDX API in the settings, your liquidity overview might look like this.

Overview

Import Liquidity: Import existing liquidity positions into your overview. (Only necessary if KoinDX API is deactivated)

Add Liquidity: Choose a token pair and amount to add to a liquidity pool.

Remove Liquidity: Withdraw your assets from a liquidity pool.

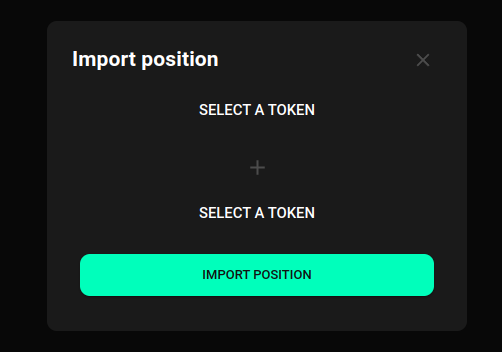

Import Positions (Only necessary if KoinDX API is deactivated)

- If you want to add an existing position to the overview, for which you already provide liquidity, simply click on Import.

- A modal will show you two select inputs. Choose the trading pair of your position which you want to import.

- To confirm your selection click on Import Position.

If the liquidity does not show up after importing, try to reload the page.

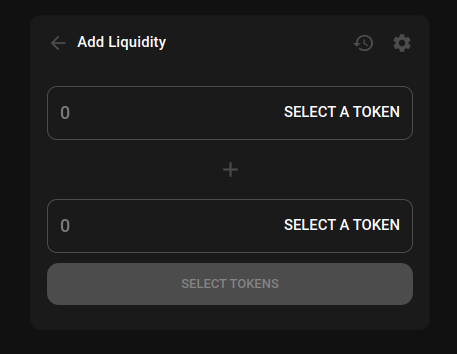

Providing Liquidity

- Go to our Add Liquidity page

- Select the token pair you want to provide liquidity for.

- Enter the amount of token you want to add.

- Confirm your selection by clicking Select Tokens and sign the transaction.

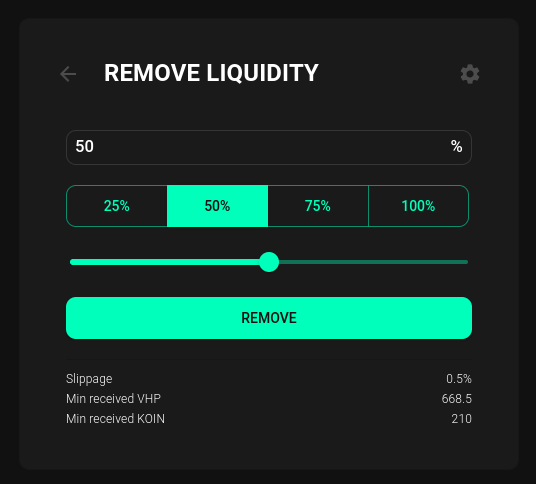

Removing Liquidity

- Go to the overview page of the liquidity category.

- Make sure your liquidity position is imported.

- Expand the relevant token pair card

- Click on Remove

- Set the amount (%) of how much liquidity you want to remove

- Confirm the transaction

Liquidity in greater detail

In a decentralized exchange like KoinDX, liquidity providing involves depositing funds into a liquidity pool for a particular token pair, such as KOIN and VHP. This liquidity pool is used to facilitate trades between buyers and sellers on the exchange.

When you deposit funds into the liquidity pool, you receive liquidity provider (LP) tokens in return. These LP tokens represent your share of the liquidity pool and can be redeemed for your share of the pool plus additionally the portion of the trading fees earned by the pool.

For example, let's say you deposit 10,000 KOIN and 10,000 VHP into the KOIN/VHP liquidity pool on KoinDX. This gives you a 50% share of the total liquidity pool, which then has a total value of 20,000 KOIN and 20,000 VHP.

If someone wants to trade 1,000 KOIN for VHP on KoinDX, the trade would be executed against the liquidity pool. This means that the trader's 1,000 KOIN would be swapped for an equivalent amount of VHP from the pool, and the trading fees for this transaction would be charged.

At KoinDX, the current swap fee is 0.25%, so in this example, the trading fee would be 2.5 KOIN. Of this fee, 0.17% or 1.7 KOIN is paid to the liquidity providers as an incentive, and 0.08% or 0.8 KOIN is retained by the protocol as earnings.

Since you own 50% of the liquidity pool, you would be entitled to half of the trading fees earned by the pool. In this case, your share of the trading fees would be 0.85 KOIN, which would be added to your holdings in the liquidity pool.

As more traders use the KOIN/VHP liquidity pool, the trading fees earned by the pool will increase, and your share of the fees will increase as well. However, it's important to note that the value of your LP tokens may fluctuate depending on the market conditions and the demand for the token pair.